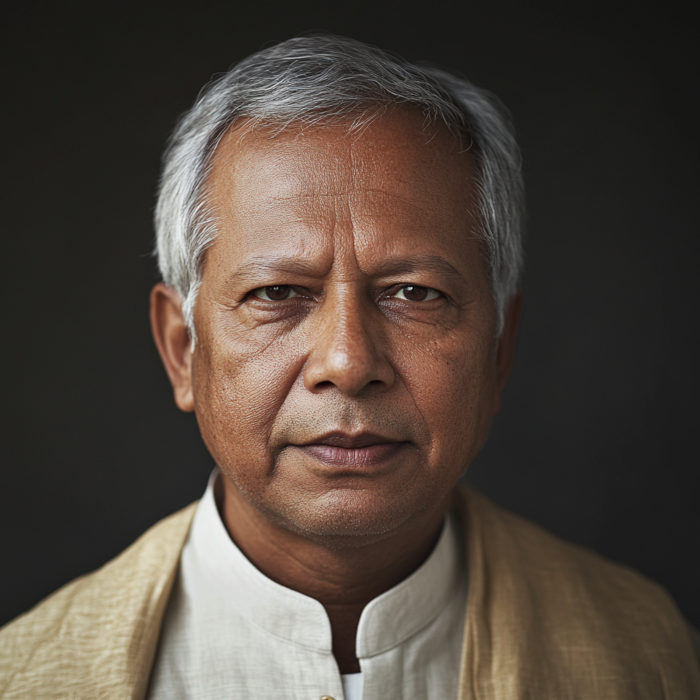

Muhammad Yunus (born June 28, 1940) is a Bangladeshi social entrepreneur, economist, and civil society leader who is best known for pioneering the concepts of microcredit and microfinance. Through these innovations, he helped empower millions of impoverished individuals, especially women, by providing them with small loans to start or expand small businesses. Yunus’s work has had a profound impact on global poverty alleviation efforts, earning him the Nobel Peace Prize in 2006.

Yunus showed academic promise from a young age. He attended Chittagong Collegiate School and then Chittagong College, before moving to Dhaka to attend Dhaka University, where he earned a Bachelor’s and a Master’s degree in Economics.

In 1971, when Bangladesh won its independence from Pakistan after a brutal war, Yunus returned to his homeland to contribute to the nation-building efforts. He initially took a position as the head of the Economics Department at Chittagong University.

During the famine of 1974 in Bangladesh, Yunus became deeply troubled by the severe poverty and suffering he witnessed in the villages around the university. He began to seek practical ways to address these problems beyond the theories and models he had studied.

Yunus observed that these small loans had a significant impact on the borrowers' lives, allowing them to improve their economic situation without the crippling burden of high-interest debt from informal moneylenders.

Growth of Microfinance: The success of Grameen Bank led to the global spread of microcredit and microfinance as tools for poverty alleviation. Similar programs have been implemented in many countries, adapting Yunus's model to different contexts. Microfinance has been recognized as a powerful tool in empowering the poor, especially women, and in fostering economic development at the grassroots level.

Nobel Peace Prize: In 2006, Muhammad Yunus and Grameen Bank were jointly awarded the Nobel Peace Prize for their efforts to create economic and social development from below. The Nobel Committee recognized microcredit as an important instrument in the fight against poverty, and Yunus’s work was celebrated for its innovative approach to addressing one of the world’s most pressing challenges.

Other Awards and Honors: Yunus has received numerous awards and honors throughout his career, including the Presidential Medal of Freedom and the Congressional Gold Medal from the United States, among many others. He is also the author of several books, including Banker to the Poor, which chronicles his journey in creating Grameen Bank and the impact of microcredit.

Beyond microfinance, Yunus has continued to be an active advocate for social business, a concept he promotes as a means to solve social problems using business principles without a focus on profit maximization. He believes in creating enterprises where the profits are reinvested into the business or used for social causes rather than distributed to investors.

Yunus Centre: In 2006, Yunus established the Yunus Centre in Dhaka as a global hub for promoting his ideas on social business and combating poverty. The center works on initiatives aimed at creating sustainable development and empowering disadvantaged populations.

Grameen Social Business: Yunus has also been involved in the establishment of various social business ventures, including partnerships with multinational companies to create businesses that address social issues such as healthcare, nutrition, and environmental sustainability.

Despite his achievements, Yunus has faced challenges and controversies, particularly in his home country. In 2011, he was forced to step down as the managing director of Grameen Bank by the Bangladeshi government, which cited age limits as the reason. However, many observers believe the move was politically motivated due to tensions between Yunus and the government.

Yunus has also been criticized by some for the high-interest rates charged by some microfinance institutions, although these criticisms generally pertain to other institutions that have adopted microfinance principles rather than Grameen Bank itself.

Muhammad Yunus is widely regarded as a pioneer in the field of microfinance and a tireless advocate for the poor. His work has had a transformative impact on the lives of millions of people around the world, demonstrating that small amounts of capital, when placed in the hands of the poor, can have a powerful and positive effect on their lives and their communities.

Yunus’s ideas have not only contributed to poverty reduction but have also influenced broader discussions about the role of business in society, the potential of social entrepreneurship, and the importance of economic empowerment as a tool for achieving peace and development. His legacy continues to inspire efforts to create a more inclusive and equitable world.

We use cookies

We use cookies and other tracking technologies to improve your browsing experience on our website, to show you personalized content and targeted ads, to analyze our website traffic, and to understand where our visitors are coming from. Privacy Policy.